The Report Cube has released its latest study, InsurTech Market Size and Research Report 2032,” offering comprehensive insights. The report provides detailed analysis on market trends, competitive landscape, regional performance, and key segment breakdowns.

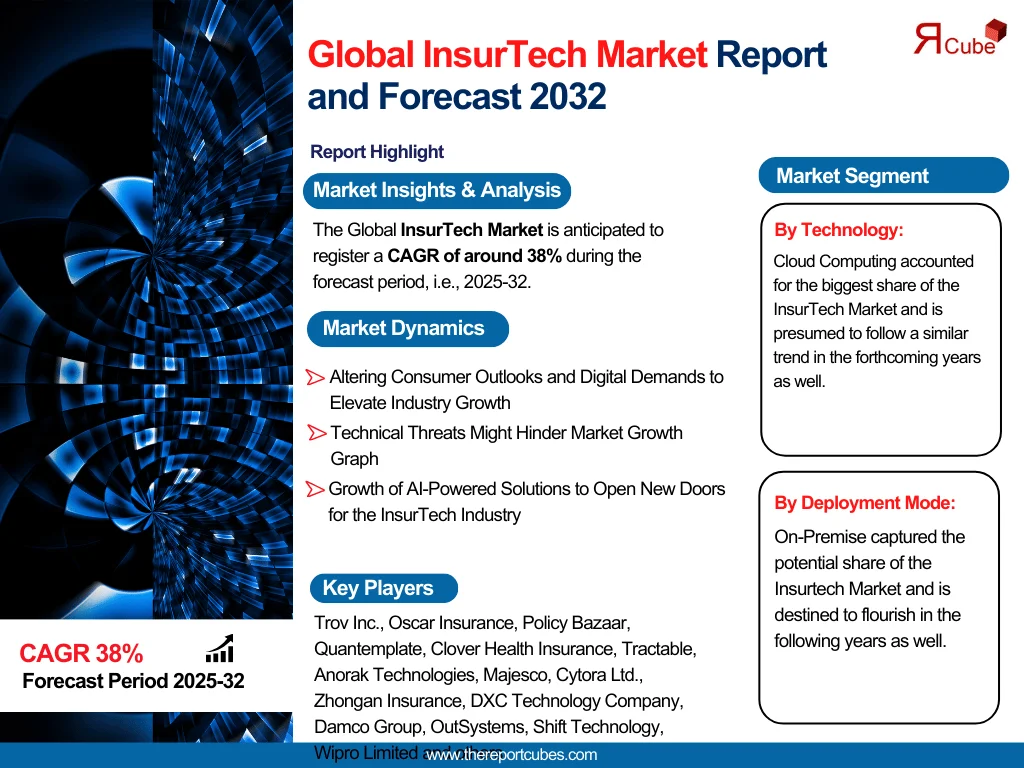

According to the findings, the InsurTech Market is anticipated to register a CAGR of around 38% during the forecast period, i.e., 2025-32.

Report Attributes and Key Highlights – The Report Cube

Report Title: InsurTech Market Size and Research Report 2032

Publisher: The Report Cube

Market Size (2023): —

Market Forecast (2032): —

CAGR (2025–2032): 38%

Coverage: Market trends, competitive landscape, segment analysis, and regional insights

Scope: Unlocks growth opportunities for stakeholders, investors, and companies shaping the future of the InsurTech Market

Gain deeper insights by asking for a free sample PDF now – https://www.thereportcubes.com/request-sample/insurtech-market

InsurTech Market Dynamics

- Altering Consumer Outlooks and Digital Demands to Elevate Industry Growth

The insurtech enterprise is swiftly expanding as a result of ever-changing consumer desires and the growing need for frictionless digital experiences. Furthermore, insurtech companies are capitalizing on this industry demand by offering user-friendly online platforms and mobile apps that let clients easily purchase policies, file claims, and access data. This shift toward digitalization raises customer satisfaction and enables insurers to engage with their policyholders better. It prompts traditional insurance businesses to invest in insurtech solutions to remain competitive and relevant in a quickly changing landscape dominated by customer-centricity. Hence, this, in turn, is driving the InsurTech market growth to gain profitable prospects during the projected period.

- Technical Threats Might Hinder Market Growth Graph

Technical hazards can pose challenges to the Global InsurTech Industry. Technology drives innovation in the insurance industry, however, it also introduces several risks that must be carefully managed. Cyberattacks target InsurTech firms as they handle massive amounts of sensitive client data. Threats linked with data breaches, illicit access, and other cybersecurity vulnerabilities could result in large-scale monetary losses, reputational harms, and legal complications.

Additionally, it can be challenging to employ & deploy new technologies into existing systems. The revolutionary technology that InsurTech businesses aspire to implement might not be easily integrated with the insurance industry’s outdated structures. This could lead to delays, increased costs, and operational interruptions. These companies usually rely on third-party vendors for cloud services, data analytics platforms, software tools, and other technical solutions. Also, relying on third-party providers exposes the InsureTech company to the risk of service disruptions, outrages, and several other issues outside its direct control. Thus, all of these concerns might slow the expansion of the Global insurance technology trends in the forecast years.

- Growth of AI-Powered Solutions to Open New Doors for the InsurTech Industry

AI-powered solutions are generating substantial developments in the insurtech business by allowing for more advanced underwriting, risk evaluation, and customer service tools. AI technologies, like ML & natural learning processing, offer the ability to evaluate massive amounts of data & provide previously unreachable insights. These methods improve underwriting efficiency by detecting trends & determining risk more precisely.

Moreover, AI-powered technologies enhance customer service by making personalized recommendations, automating regular chores, and dealing with client inquiries more efficiently. The consistent evolution of AI technologies provides opportunities to create novel insurance products & services that match the evolving requirements of customers, further creating profitable prospects for the InsurTech Industry in the coming years.

InsurTech Market Segmentation:

- Market Share, By Technology

- Block chain

- Cloud Computing

- Internet of Things (IoT)

- Machine Learning (ML)

- Artificial Intelligence (AI)

- Drones

- Market Share, By Deployment Mode

- On-Premise

- Cloud

- Market Share, By Application

- Life and Accident Insurance

- Health and Medical Insurance

- P&C Insurance

- Commercial Insurance

- Insurance Administration and Risk Consulting

- Annuities

- Market Share, By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Unlock the entire dataset and analysis by securing your full report now – https://www.thereportcubes.com/report-store/insurtech-market

Top Players in InsurTech Market:

Trov Inc., Oscar Insurance, Policy Bazaar, Quantemplate, Clover Health Insurance, Tractable, Anorak Technologies, Majesco, Cytora Ltd., Zhongan Insurance, DXC Technology Company, Damco Group, OutSystems, Shift Technology, Wipro Limited

Key Highlights of the InsurTech Market Report:

Market Size – The total value or volume of products/services sold.

Growth Rate – How fast the market is expanding or shrinking.

Customer Segments – Different groups of buyers with unique needs and preferences.

Trends – Current patterns shaping the market

Competition – Major players, rivals, and how intense the competition is.

Opportunities – Areas where businesses can grow or innovate.

Challenges – Barriers such as regulations, costs, or customer expectations.

Question and Answers for This Report

• What is the current size of the InsurTech Market?

• What is the InsurTech Market share distribution across key segments?

• What are the key segments of the InsurTech Market?

• At what CAGR is the InsurTech Market expected to grow during the forecast period?

• What are the latest trends shaping the InsurTech Market?

• What are the major drivers of InsurTech Market growth?

• What opportunities exist in the InsurTech Market?

• What challenges could impact the InsurTech Market outlook?

• Who are the top companies operating in the InsurTech Market?

• Can this InsurTech Market report be customized to specific business needs?

Note: This report can be customized to include any information beyond its current scope.

About Us:

At Report Cube, we are leading market research company in UAE; we are your strategic partner in unlocking the insights that drive your business forward. With a passion for data, a commitment to precision, and a dedication to delivering actionable results, we have been a trusted resource for businesses seeking a competitive edge.

Our mission is to empower businesses with the knowledge they need to make informed decisions, innovate, and thrive in an ever-evolving marketplace. We believe that data-driven insights are the cornerstone of success, and our team is dedicated to providing you with the highest quality research and analysis to help you stay ahead of the curve

For further support, reach out to our expert analysts today

The Report Cube

Burjuman Business Tower, Burjuman, Dubai

Tel : +971 564468112 (WhatsApp)

Email : sales@thereportcubes.com

Press Release – https://www.thereportcubes.com/press-release

Trending Blog – https://www.thereportcubes.com/blogs