Have you ever wondered how your financial analysis could be faster if every figure you used were accurate, consistent, and instantly available? In today’s competitive economic environment, speed and precision are essential for lenders, analysts, and corporate decision-makers.

This blog explores how modern financial spreading software with high-accuracy document capture transforms how organizations handle financial data. We will delve into its role in commercial lending, investment analysis, economic modeling, and operational efficiency while highlighting the core features that make it indispensable in 2025.

Accuracy that Builds Trust

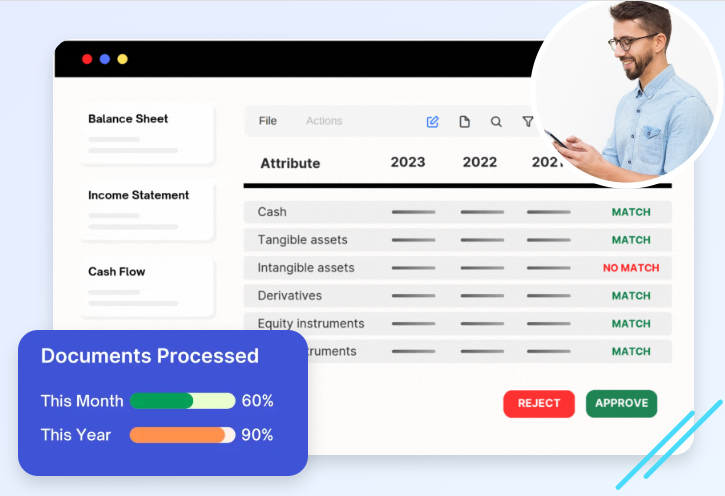

Accuracy is the foundation of all financial decision-making. High-accuracy document capture within financial spreading software ensures that data is extracted quickly and has the consistency and reliability required for critical evaluations. Advanced AI models validate figures, cross-checking them across different financial statements to ensure alignment. This means that the information disclosed in notes matches the main reports, and that earnings statements align with investor presentations. This level of accuracy builds confidence for lenders, investors, and stakeholders.

Transforming Commercial Lending

In commercial lending, assessing creditworthiness and identifying risk factors can make or break a deal. With precision document capture, financial spreading software evaluates liquidity ratios, solvency metrics, and historical performance trends in a fraction of the time it takes with manual methods. Lenders gain the ability to approve loans faster while reducing the risk of errors. This acceleration improves client satisfaction and increases the capacity to process more applications without sacrificing quality.

Elevating Equity Research and Investment Banking

Accurate, timely data is vital for equity research analysts and investment bankers. Financial spreading software automatically pulls relevant data from earnings statements, investor presentations, and annual reports and organizes it for portfolio analysis and valuation. Including trend analysis helps identify patterns and outliers over time, allowing professionals to make strategic buy, sell, or hold recommendations confidently. This efficiency enables analysts to focus more on insights and less on repetitive data entry.

Powering More Reliable Financial Modeling

Financial models depend on clean, well-structured data. Financial spreading software dramatically reduces the risk of feeding models with inconsistent or incomplete figures. Standardized data inputs mean models are built faster and produce more reliable results. Features like automated financial ratio calculation and company scoring enhance the ability to compare performance across different firms and periods. For corporate strategists, this translates into sharper forecasts and better scenario planning.

Advanced Document Intelligence Features

At the heart of modern financial spreading software is its document intelligence. This includes the ability to scan and interpret multi-column layouts, complex tables, and visual elements like charts with semantic classification. It accurately identifies whether figures belong to a balance sheet, income statement, cash flow statement, or supporting notes. Once captured, data is mapped into fully customized templates, normalized into a standard format, and validated for consistency. This comprehensive approach ensures no detail is lost in translation from document to analysis platform.

The Power of Reconciliation

Reconciliation is one of the most time-consuming aspects of financial analysis, yet it is crucial for ensuring accuracy. Financial spreading software automates this by verifying that every figure in the financial statements is interconnected. Whether matching the cash flow statement to the income statement or ensuring that disclosures in notes align with reported totals, automated reconciliation produces a unified view of an organization’s financial health. This not only streamlines workflows but also strengthens compliance and investor trust.

Operational Advantages and Usability

Beyond analytics, financial spreading software delivers operational efficiencies that benefit the entire organization. Centralized document management hubs allow easy access to all financial files from a single location. Customer onboarding interfaces simplify adding and managing client data with complete transparency. Interactive dashboards turn complex financial results into visual insights, making them easier for executives to interpret and act upon. These tools create an end-to-end solution that integrates seamlessly into daily operations.

Preparing for the Future of Financial Analysis

The adoption of AI-driven financial spreading software is accelerating across industries, from banking to manufacturing. The combination of high-accuracy document capture, automated reconciliation, and advanced analytics is redefining what is possible in financial reporting and decision-making. Organizations that embrace this technology are now positioning themselves to respond faster to market changes, improve risk management, and confidently make data-driven decisions.

Conclusion

In an era where precision and speed define success, financial spreading software with high-accuracy document capture is no longer a luxury. It is a strategic necessity. By automating data extraction, ensuring accuracy through built-in validation, and delivering insights through trend analysis and standardized reporting, this technology empowers professionals in lending, investment, and corporate finance.

The ability to quickly process and trust financial data can mean the difference between seizing an opportunity and missing it. As the economic landscape evolves in 2025, those investing in advanced financial spreading capabilities will gain a decisive edge. Accurate, timely, and well-structured information is the currency of more intelligent business decisions, and the right software ensures you have it when you need it most.