The microfinance industry plays a vital role in empowering small businesses, self-employed individuals, and low-income communities. However, managing microloans efficiently demands accuracy, transparency, and scalability—something manual systems often fail to provide. That’s where Software for Microfinance by Intelligrow Consultancy Services Pvt Ltd makes all the difference.

This comprehensive, technology-driven solution simplifies the entire microfinance process—from client onboarding and loan disbursement to repayment tracking and reporting—ensuring a seamless and error-free operation.

Why Software for Microfinance Is Essential in Today’s Financial Landscape

Microfinance institutions (MFIs) cater to millions of borrowers who rely on small, short-term loans. Managing such a vast network manually is challenging, time-consuming, and prone to human error. Implementing the right Software for Microfinance transforms these challenges into opportunities.

Intelligrow Consultancy Services Pvt Ltd understands that the heart of microfinance lies in trust and timely service. Our software enhances operational efficiency, reduces risks, and ensures compliance with evolving financial regulations.

By adopting our advanced Software for Microfinance, institutions can scale their operations, improve accuracy, and deliver faster, more reliable financial services to underserved populations.

Key Features of Intelligrow’s Software for Microfinance

1. Seamless Loan Management

The system automates the entire lending cycle—from application to disbursement and repayment. It allows real-time monitoring of loan accounts and simplifies processes for field officers and management teams alike.

2. Digital Client Onboarding

With digital KYC and biometric verification, onboarding new clients becomes effortless. Borrowers’ details are captured instantly, eliminating paperwork and ensuring compliance with regulatory norms.

3. Group and Individual Lending

Our Software for Microfinance supports both group and individual lending models. It manages member-based lending structures, group formation, meeting schedules, and collection tracking efficiently.

4. Automated Repayment Tracking

The platform automates EMI collection and repayment tracking. Field agents can record transactions digitally, ensuring accuracy and eliminating delays in data updates.

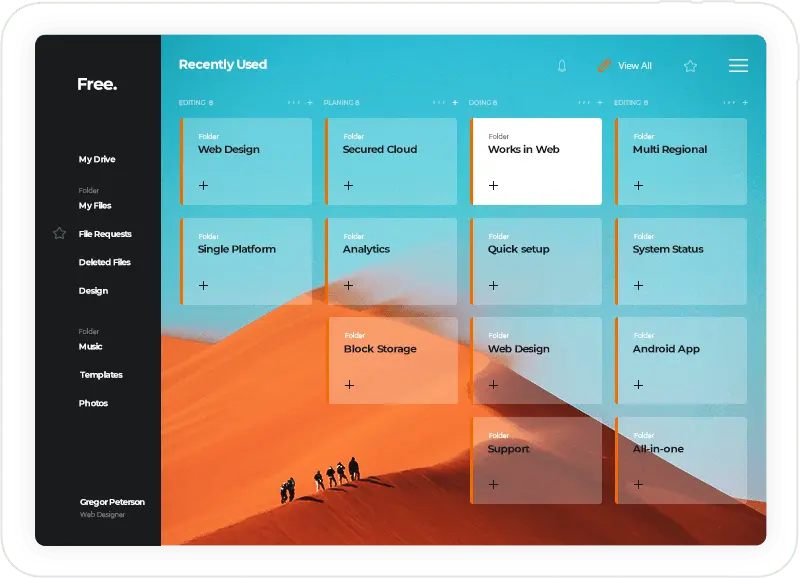

5. Real-Time Analytics and Dashboards

Access performance insights through visual dashboards. The software provides analytics on loan portfolios, repayment patterns, and delinquency rates, enabling data-driven decisions.

6. Multi-Branch Management

For organizations operating across regions, our system centralizes data while allowing independent branch-level operations. This ensures consistency, transparency, and easy scalability.

7. Secure and Compliant Platform

Data security and compliance are at the core of Intelligrow’s software. Built with robust encryption and audit trails, it adheres to RBI, NBFC, and microfinance industry standards.

How Software for Microfinance Transforms Lending Operations

Implementing Software for Microfinance revolutionizes the way MFIs work. It enhances efficiency, minimizes risks, and delivers a better experience to both borrowers and staff.

Here’s how Intelligrow Consultancy Services Pvt Ltd helps organizations transform their operations:

- Increased Efficiency: Automation eliminates repetitive manual work.

- Reduced Errors: Digital data entry minimizes inaccuracies.

- Faster Turnaround Time: Approvals and disbursements happen within hours, not days.

- Improved Transparency: Centralized systems ensure visibility across branches.

- Better Compliance: Built-in regulatory features reduce legal risks.

By digitizing the entire lending process, MFIs can serve more clients, scale their reach, and ensure long-term sustainability.

Industries Benefiting from Software for Microfinance

1. Microfinance Institutions (MFIs)

The software simplifies daily operations such as group formation, loan processing, repayment collection, and record maintenance, ensuring smoother workflows.

2. Non-Banking Financial Companies (NBFCs)

NBFCs engaged in micro-lending can use the system to manage large customer bases, automate approvals, and maintain transparent loan records.

3. Cooperative Credit Societies

Our Software for Microfinance supports cooperative societies in managing members, loans, and collections while ensuring data integrity.

4. Self-Help Groups (SHGs)

The system manages SHG accounts, meeting records, and fund disbursements efficiently, reducing dependency on manual registers.

5. Rural and Urban Banks

Banks offering small-scale credit can use Intelligrow’s solution to streamline microloan processing and deliver faster, more accurate financial services.

Benefits of Using Intelligrow’s Software for Microfinance

1. Enhanced Operational Control

Centralized dashboards give management real-time visibility into branch performance, repayments, and customer portfolios.

2. Better Risk Management

The software evaluates borrower profiles, repayment history, and credit scores to reduce default risks and improve lending accuracy.

3. Time and Cost Efficiency

Automation reduces paperwork, administrative overhead, and manual errors, leading to substantial cost savings.

4. Scalability and Flexibility

As organizations expand, the software scales easily to accommodate new branches, customers, and loan products.

5. Customer Satisfaction

Borrowers benefit from quick approvals, transparent terms, and easy repayment options, resulting in stronger customer trust.

Why Choose Intelligrow Consultancy Services Pvt Ltd?

Intelligrow Consultancy Services Pvt Ltd is a trusted name in the financial technology sector, offering customized software solutions for financial institutions, NBFCs, and MFIs.

Our deep understanding of the microfinance ecosystem allows us to design systems that address the specific needs of field officers, borrowers, and management teams.

Here’s what makes us different:

- Tailor-made software designed for diverse microfinance models

- User-friendly interface suitable for both technical and non-technical users

- Reliable support team ensuring smooth implementation and maintenance

- Regular updates aligned with financial regulations and market trends

With Intelligrow, institutions not only digitize but also optimize their entire lending workflow.

Implementation and Training Support

Adopting a new system can be challenging, but with Intelligrow, the transition is seamless. Our experts assist in software installation, data migration, and user training to ensure a smooth rollout.

We provide end-to-end implementation support—covering onboarding, field staff orientation, and post-launch assistance. This ensures every user, from field agents to senior management, can leverage the software’s full potential.

Continuous technical support, updates, and performance monitoring make Intelligrow’s solution both reliable and future-ready.

The Future of Microfinance Lies in Digital Transformation

The microfinance industry is rapidly evolving with digital technology. Mobile banking, AI-based credit scoring, and cloud computing are redefining financial inclusion.

Intelligrow Consultancy Services Pvt Ltd continues to innovate its Software for Microfinance, incorporating smart analytics, automation, and mobile accessibility. Our goal is to empower financial institutions to serve more clients efficiently while maintaining accuracy and compliance.

As the world moves toward paperless and data-driven systems, microfinance institutions that embrace technology today will lead tomorrow’s financial revolution.

Conclusion

In a dynamic financial world, efficiency and transparency define success. Software for Microfinance by Intelligrow Consultancy Services Pvt Ltd is the ultimate solution for institutions seeking to enhance performance, minimize errors, and deliver faster, more transparent lending services.

Whether you manage a microfinance institution, NBFC, or cooperative society, adopting this powerful software ensures streamlined operations and improved client satisfaction.

With Intelligrow’s advanced Software for Microfinance, you can achieve financial excellence, empower communities, and drive sustainable growth—one digital step at a time.