Middle East Real Estate Market Overview

Market Size in 2024: USD 388.7 Billion

Market Size in 2033: USD 834.8 Billion

Market Growth Rate 2025-2033: 8.2%

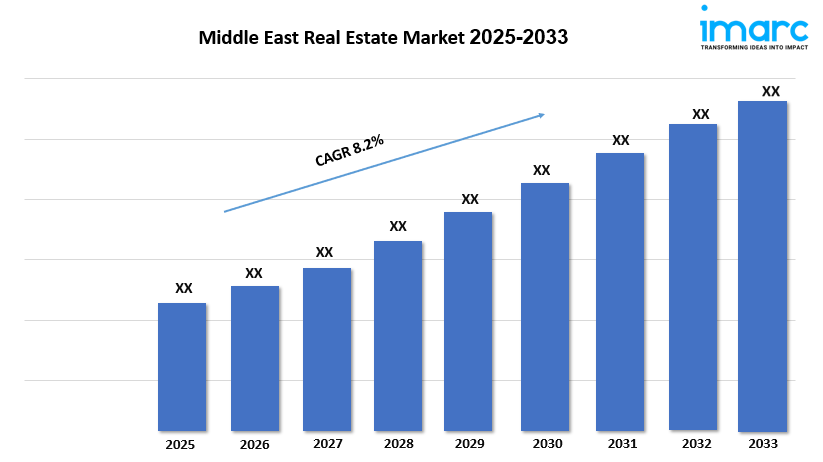

According to IMARC Group’s latest research publication, “Middle East Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The Middle East real estate market size reached USD 388.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 834.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.2% during 2025-2033.

How AI is Reshaping the Future of Middle East Real Estate Market

- Transforming Property Search and Discovery: AI-powered platforms are revolutionizing property discovery through predictive pricing algorithms, AR/VR virtual tours, and machine learning-based recommendation systems, reducing property search time by 40-50% while enabling remote property transactions and attracting international buyers from Europe and Asia with AED 262.1 billion in residential transactions recorded in H1 2025.

- Enhancing PropTech Innovation: Advanced AI analytics are transforming the UAE’s PropTech sector, valued at AED 2.24 billion in 2024 and projected to reach AED 5.69 billion by 2030 at a CAGR of 17.49%, with 189 firms operating in the sector and driving innovations in automated property valuations, tenant behavior forecasting, and portfolio optimization across the region.

- Optimizing Smart Building Management: IoT-enabled AI systems are revolutionizing building operations through intelligent energy management, predictive maintenance, and automated climate control, reducing operational costs by 20-30% while supporting the Middle East’s green building initiatives and LEED certification requirements across mega-developments in Dubai, Riyadh, and Doha.

- Streamlining Transaction Processes: Blockchain-integrated AI platforms are transforming property transactions through tokenized real estate, fractional investment opportunities, and automated title registration systems, reducing transaction time by 60-70% while enhancing transparency and security, with Dubai launching dedicated PropTech hubs attracting over $300 million in investments.

- Facilitating Investment Intelligence: AI-driven market analytics and digital twin technologies are providing real-time risk modeling, ESG compliance tracking, and scenario-based crisis forecasting for investors, with Gulf region PropTech startups attracting $200 million in venture capital during H1 2024, surpassing even fintech investments and enabling data-driven investment decisions across residential, commercial, and industrial segments.

Grab a sample PDF of this report: https://www.imarcgroup.com/middle-east-real-estate-market/requestsample

Middle East Real Estate Market Trends & Drivers:

The Middle East real estate market is experiencing unprecedented growth driven by ambitious Vision 2030 mega-projects, with Saudi Arabia’s NEOM alone representing a $500 billion investment and having spent $37 billion on infrastructure development by early 2025. The Kingdom’s real estate market is projected to see prices rise by 15-20% through 2025, driven by giga-projects including NEOM, Red Sea Project, Qiddiya, and preparations for EXPO 2030 and FIFA World Cup 2034. Dubai’s residential sector recorded transactions worth AED 262.1 billion in H1 2025, representing a 36.4% increase in value compared to H1 2024, with off-plan transactions surging to over 70% of all property sales as buyers capitalize on flexible payment plans and price appreciation potential.

Rapid urbanization and population growth are reshaping demand dynamics across the region, with the UAE planning to develop over 28,700 villas by 2025 to meet the needs of expanding expatriate populations and high-net-worth individuals. Dubai alone is expected to attract over 9,800 millionaires, while NEOM aims to host 9 million residents by 2045, contributing $48 billion annually to the national economy. The influx of ultra-high-net-worth individuals and family offices to the UAE is underpinning strong demand for prime residential properties, with Dubai’s prime real estate outpacing global markets with over 5% growth in 2025, while Saudi housing deals hit $33 billion in H1 2025 across Riyadh, Jeddah, and Madinah.

The PropTech revolution is transforming market operations, with the global PropTech market valued at $47.08 billion in 2025 and forecast to reach $179.03 billion by 2034 at a CAGR of 16%. The UAE has emerged as the fastest-growing PropTech hub in MENA with 189 firms operating in 2025, nearly triple the number from two years earlier. Sustainability initiatives are gaining momentum, with projects like NEOM’s The Line, Masdar City, and Dubai’s Sustainable City pioneering eco-friendly urban living powered by renewable energy. Dubai launched its Smart Rental Index 2025, integrating advanced technologies to enhance transparency and fairness, while regulatory reforms across Saudi Arabia and the UAE are simplifying foreign ownership rules, with Saudi Arabia introducing new mortgage programs and property acquisition frameworks that make the market more accessible to international investors.

Middle East Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Property Insights:

- Residential

- Commercial

- Industrial

- Land

Business Insights:

- Sales

- Rental

Mode Insights:

- Online

- Offline

Breakup by Country:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Middle East Real Estate Market

- February 2025: NEOM spent over $37 billion on infrastructure development, with The Line’s first phase scheduled to open in 2030 as part of Saudi Arabia’s $500 billion giga-project, while securing a $3 billion multi-currency loan from nine international banks to support continued development across the 26,500 square kilometer site.

- January 2025: Dubai approved implementation of housing projects worth AED 5.4 billion ($1.5 billion) to benefit citizens across different areas, while launching the Smart Rental Index 2025 to enhance transparency and fairness in rental valuations, aligning with Dubai’s Digital Strategy and Real Estate Sector Strategy 2033 objectives.

- December 2024: NEOM’s Sindalah luxury island destination completed its opening phase, becoming the first operational component of the mega-project, while UAE real estate developers including Damac, Aldar, and Modon launched development operations in London through subsidiaries, diversifying their portfolios as Emirati buyers now represent 3% of London investors, a fivefold increase from the previous year.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302