In today’s fast-paced financial landscape, efficiency and accuracy are the keys to success. Microfinance institutions face unique challenges, from managing multiple loan accounts to ensuring timely recovery and compliance. Microfinance Loan Management Software from Intelligrow Consultancy Services Pvt Ltd is designed to address these challenges effectively.

With this advanced software, institutions can automate loan processes, reduce errors, and focus more on client relationships and business growth. Let’s explore how this solution can revolutionize microfinance operations.

Why Microfinance Loan Management Software is Essential

Managing loans manually or through outdated systems often leads to errors, delays, and poor reporting. Microfinance organizations handle numerous small loans, making tracking and collection complicated. A dedicated Microfinance Loan Management Software ensures that every step – from loan origination to closure – is automated, transparent, and efficient.

Key benefits include:

- Automated Loan Processing: Reduce manual paperwork and speed up loan approvals.

- Accurate Record-Keeping: Maintain precise borrower and transaction data.

- Compliance Management: Adhere to regulatory requirements effortlessly.

- Real-Time Reporting: Make informed decisions with instant insights.

By integrating such software, institutions can enhance productivity, reduce operational costs, and improve client satisfaction.

Features of Intelligrow’s Microfinance Loan Management Software

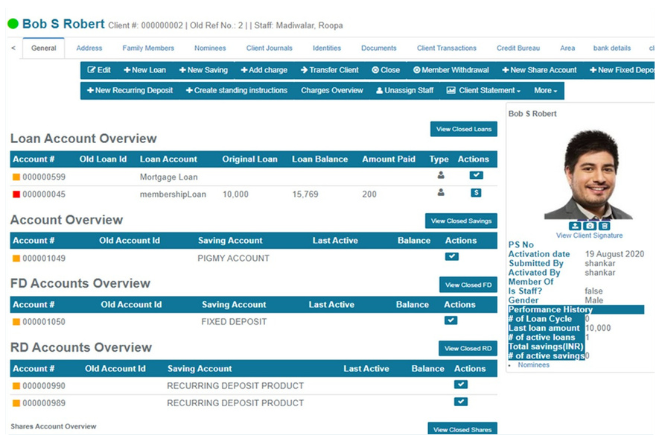

Intelligrow’s software is built with the latest technology to simplify every aspect of microfinance lending. Some notable features include:

1. Loan Origination and Disbursement

The software streamlines loan application, verification, and approval. Automated workflows ensure timely disbursement while reducing errors.

2. Portfolio Management

Monitor multiple loan accounts and track repayments efficiently. The system allows quick access to borrower profiles and outstanding dues.

3. Repayment Scheduling

Flexible repayment schedules help borrowers stay on track while enabling institutions to forecast cash flows accurately.

4. Risk Assessment and Analytics

Advanced analytics help identify defaulters early, assess creditworthiness, and manage risk effectively.

5. Secure Data Management

All sensitive data is stored securely, protecting both borrowers and financial institutions from fraud and breaches.

These features collectively improve the operational efficiency of microfinance organizations, making them more competitive and client-friendly.

How Microfinance Loan Management Software Improves Efficiency

By automating repetitive tasks, the software allows staff to focus on strategic activities such as client engagement and business expansion. Key efficiency improvements include:

- Reduced Manual Errors: Automation minimizes mistakes in data entry and calculations.

- Faster Loan Approvals: Streamlined workflows accelerate the approval process.

- Enhanced Transparency: Clear records and reporting improve trust with stakeholders.

- Improved Customer Experience: Quick processing and easy access to loan information enhance borrower satisfaction.

Using Microfinance Loan Management Software, institutions can significantly reduce administrative burden while improving operational accuracy and accountability.

Why Choose Intelligrow Consultancy Services Pvt Ltd

Intelligrow Consultancy Services Pvt Ltd has years of experience in providing technology solutions tailored for the financial sector. Their microfinance software is trusted for its:

- User-friendly interface for staff and management

- Scalability to handle growing loan portfolios

- Integration capabilities with existing accounting or ERP systems

- Continuous technical support and updates

Partnering with Intelligrow ensures that microfinance institutions adopt a solution that is both robust and future-ready.

Conclusion

Microfinance institutions are the backbone of financial inclusion, and their success depends on operational efficiency, accuracy, and compliance. Microfinance Loan Management Software by Intelligrow Consultancy Services Pvt Ltd addresses these needs by automating loan processing, improving record-keeping, and providing real-time insights.

Investing in such technology not only enhances productivity but also strengthens client relationships and supports sustainable growth. For institutions looking to modernize their operations and gain a competitive edge, Intelligrow’s software is the ideal solution.

With the right tools, managing microfinance loans becomes easier, faster, and more transparent – empowering organizations to focus on what matters most: serving their communities effectively.

Related Reads

- Hyaluronic Acid Face Wash: Your Daily Dose of Hydration and Freshness

- MEAN Stack vs. MERN Stack: Which One Should You Master?

- Luxury and Comfort: Limo Service in St. Thomas

- The Importance of Preventive Health Care and Blood Tests in the UK

- The Silent Revolution of Inpage Push Ads: Why the Future of Digital Monetization Depends on Them