Debts snowball quickly if you lose track of them. Most individuals switch to debt consolidation to get a better hold of their finances. However, it does not work for everyone. In that, you must be able to save interest and total costs. It is ideal for someone who has yet to cover long-term loan payments. Otherwise, one may not save much on the interest front.

It is the reason one explores the possibilities of refinancing the expensive business loans. It is about replacing the existing loan agreement with a new one with lower interest rates and better terms. However, you can refinance only one business debt at a time, unlike debt consolidation.

What does refinancing a loan mean?

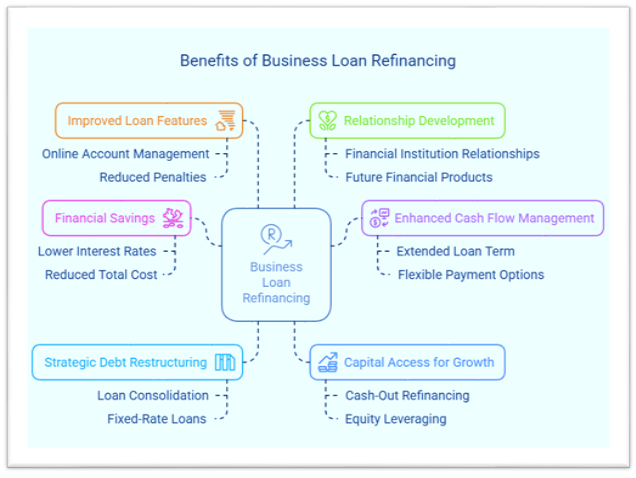

Refinancing a business loan means replacing the existing loan with a new one with fresh terms and interest rates. It involves getting a lower interest rate, smaller monthly payments, and a longer repayment structure. It is ideal to get one to manage the loan payment more easily. It helps improve business cash flow, lower the overall costs, and align the loan with the company’s current requirements.

Why you should refinance a business loan?

There could be several reasons to refinance a business loan. It could be to lower the liabilities by fetching a reduced interest rate. It may help you use the money for other purposes. Here are some other situations where you can consider refinancing expensive business loans:

Reduce monthly payments

If you have too many loan payments to tackle in a month, refinance one high-cost payment. It helps you save money on interest and monthly costs. You can free up the cash to meet other needs, like an inventory update.

Simplify the loan payments

Getting a new loan with reduced liabilities helps you repay the dues on time. It eliminates paying additional amounts in forms like penalties.

Improve business cash flow

Sometimes, you need more cash influx to meet the requirements. Here, refinancing may help release some funds locked in high-interest payments.

Under what conditions can you refinance a loan without a guarantor?

You don’t always need a guarantor to refinance a business loan. You may get loans without a guarantor if you are an established business with good personal and business credit scores. Here are other conditions in which you can refinance a loan without a guarantor:

You seek a secured refinancing option

A secured loan involves providing an asset as collateral to get a refinanced loan. It should be higher than the loan you want to refinance. It does not require you to provide a guarantor. It is backed by collateral as security and a guarantee to repay the dues.

You need a small amount

You don’t need to provide a guarantor if you need an amount below £10000 for your business requirements. Instead, you may refinance without worries. However, your total debt amount must not exceed that.

Well-established and profitable business

Consistently good business revenue showcases a company’s ability to repay its dues despite financial challenges. Thus, in this case, you don’t need to provide a guarantor.

When is the best time to refinance a business loan?

There is the right time to refinance a business loan. Here is when it is most appropriate to do that:

- The market interest rates have fallen since you took the original loan

- When the business’s financial situation improved, making it eligible for low-interest loans and terms

- When the current loan structure no longer fits the business requirements. It could be like a seasonal business that may want to fix its payment schedule.

7 Steps to refinance a business loan for the maximum benefit

Here is a structured process to follow to refinance a business loan:

Step 1- analyse the existing business debts

Identify the debts that you want to refinance. It could be credit cards, merchant cash advance, asset finance, equipment finance, etc. Note the outstanding balance, interest costs, monthly repayment, repayment term, and early repayment charges. Note any additional costs like missed payments (if any). According to Money.co.uk, one must factor in early repayment charges that may increase the troubles.

Step 2- Identify your business finances

Check whether you can support the loan payments without affecting other business liabilities. Determine your monthly expenses, like rent, utility bills, payroll, working capital needs, and marketing requirements. Refinancing means getting a new loan with reduced interest and overall payments. However, you must repay the loan. Thus, you should be sure that you can manage the payments.

Step 3- Define your purpose

What do you want to achieve by refinancing the business loan? Here are some common goals for which one refinance a business loan:

- Reduce overall interest liabilities on the loan

- Extend the loan term to make monthly payments affordable

- Consolidate debts into a single monthly payment for better financial management

- Raising more capital (if your refinance agreement permits)

Step 4- Understand the loan type required

Look at and analyse the unsecured and secured loan options. Determine which option suits your situation the best. Do you want to reduce interest liabilities drastically? A secured loan could be a great option. Alternatively, if you don’t want to risk assets and have low credit, check bad credit unsecured loans online.

You may qualify if recent business and personal financial statements reveal improvement. Always calculate the chances to qualify and the approximate costs and suitability of each loan before applying. It will help you get a better idea.

Step 5- Apply for the new loan

Determine and pre-qualify to understand the loan interest, APR, and the suitable loan terms. Check whether a long-term plan works better for you. Pre-qualifying does not affect your credit score. It just helps you get an idea of the costs. Accordingly, apply for the loan offering the lowest APR and affordable terms. It should be saving you massive amounts on the interest front.

Step 6- Close the old debt

You generally use the proceeds of the new loan to pay off the old one. Therefore, make sure the payoff is done neatly. Settle any early repayment fees and other charges involved before beginning with the new loan payments. Cancel any standing orders or direct debits regarding the old loan.

Step 7- manage the new loan

Lastly, focus on the new goal that you have now. Set new direct debits for the payments according to the payment schedule. Monitor your business’s financial performance to ensure that refinance delivers the expected benefit. Keep on reviewing the loan and the current interest rates. It may help you refinance again to a better loan with better interest rates.

Bottom line

These are some steps to refinance a business loan easily. The primary thing is to understand the end goal of refinancing. For example, if you want to do so to save money on monthly payments. Check how much you can save. If it does not save you much, then it would not be the right thing to do. Similarly, close the existing debt completely before proceeding with the new one. Consult your creditor for detailed assistance, which may eliminate any confusion.