Market Overview:

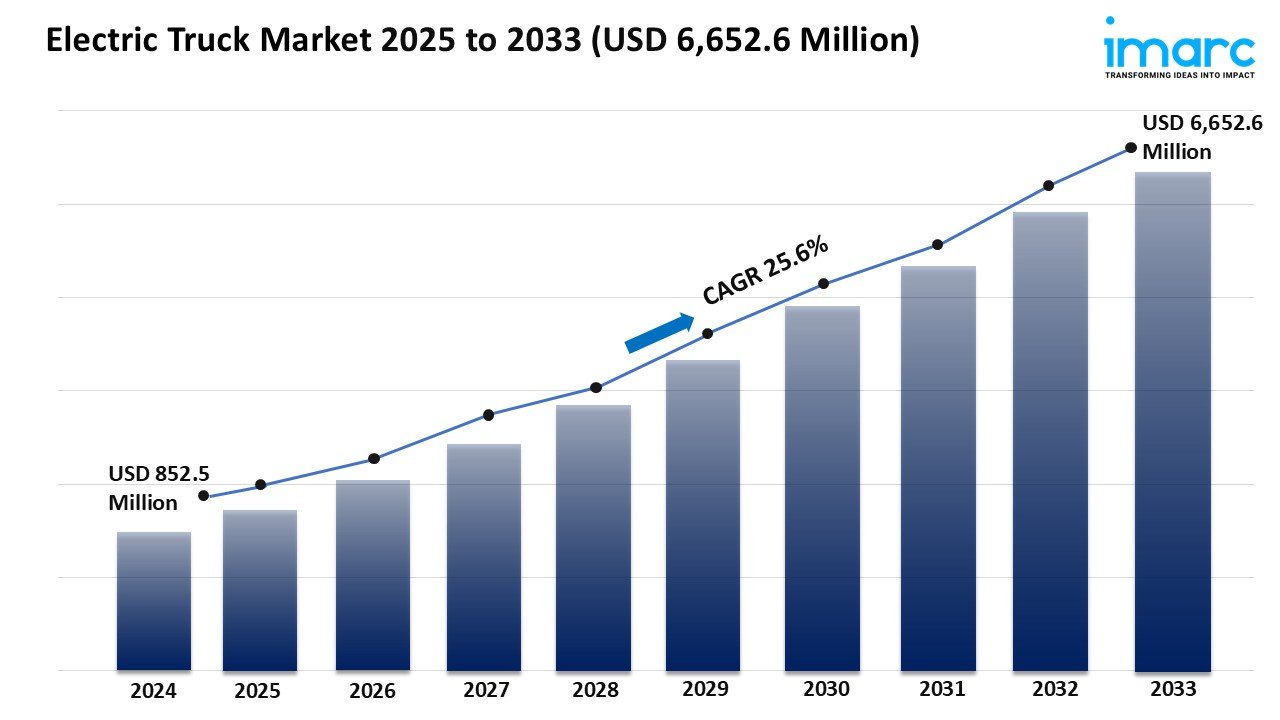

The electric truck market is experiencing rapid growth, driven by government incentives and supportive policies, advancements in battery technology and charging infrastructure, and rising economic and environmental pressures. According to IMARC Group’s latest research publication, “Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2025-2033″, the global electric truck market size was valued at USD 852.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 6,652.6 Million by 2033, exhibiting a CAGR of 25.6% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/electric-truck-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Electric Truck Market

- Government Incentives and Supportive Policies

Governments worldwide are playing a huge role in boosting the electric truck market by rolling out incentive programs and regulatory support. For example, India’s PM E-DRIVE scheme offers subsidies of up to ₹9.6 lakh per electric truck based on battery capacity, encouraging fleet operators to switch from diesel to electric. In the UK, a £246 million fund supports zero-emission heavy goods vehicles and associated infrastructure. Such initiatives reduce upfront costs and risk for buyers, making electric trucks more financially attractive. Alongside financial incentives, many regions are also introducing stringent emission standards and low-emission zones that push fleets toward cleaner vehicles. These combined policies create a favorable ecosystem, accelerating adoption while helping countries meet their climate goals by cutting transport emissions, which currently represent a substantial share of global greenhouse gases.

- Advancements in Battery Technology and Charging Infrastructure

Battery improvements have been a game changer for electric trucks, especially in terms of range, charging speed, and cost. New developments allow long-haul trucks like Volvo’s upcoming FH Aero Electric to cover up to 600 km on a single charge and reach 80% charge in just 40 minutes, which fits driver rest cycles and logistics needs. Fast-charging networks are expanding, too—companies such as Traton are investing in megawatt-class chargers capable of powering heavy trucks in under an hour. This drastically reduces downtime and increases vehicle utilization, making electric trucks a practical alternative to diesel. Additionally, ongoing advancements in battery chemistry and manufacturing help lower costs, narrowing the price gap with conventional trucks and making the electric option more accessible for operators.

- Rising Economic and Environmental Pressures

Fuel prices and emission regulations are putting growing pressure on trucking companies to seek cost-effective and sustainable alternatives. Despite their higher initial price, electric trucks offer significantly lower operating costs, including fuel savings and reduced maintenance due to fewer moving parts. In China, electric trucks have 10-26% lower total ownership costs than diesel trucks, prompting many fleet operators to electrify. Furthermore, businesses increasingly face sustainability mandates and growing consumer demand for green logistics, pushing fleets to electrify as part of corporate social responsibility and brand positioning. This combination of economic incentives and environmental responsibility is driving businesses to adopt electric trucks faster than purely regulatory measures could.

Key Trends in the Electric Truck Market

- Expansion of Electric Trucks into Medium- and Heavy-Duty Segments

One notable trend is that electric vehicles are moving beyond light urban delivery trucks into heavier classes that serve longer routes and specialized industrial functions. Recent launches like BYD’s SHARK electric pickup truck and Volvo’s long-range FH Aero Electric show a clear industry focus on medium- and heavy-duty segments. This expansion opens new markets in freight hauling, construction, and specialized transport, areas historically reliant on diesel. The availability of trucks that can handle heavier payloads with substantial range makes electrification relevant for a wider array of commercial use cases, boosting adoption and sales. It also encourages infrastructure development tailored to diverse electric truck needs, facilitating broader industry shifts.

- Growing Corporate and Public Sector Fleets Shift Toward Electrification

More companies and municipalities are converting their fleets to electric trucks as part of sustainability and operational efficiency goals. For instance, San Diego recently added electric patch trucks for road maintenance, cutting local emissions while meeting service demands. Large logistics providers are investing in electric trucks for last-mile deliveries to urban centers, where zero emissions are often mandated. Public-sector initiatives and corporate commitments are sending strong demand signals, encouraging manufacturers to scale production and innovate. This trend is creating a ripple effect, with fleet electrification becoming a competitive imperative rather than just a green choice.

- Technology Integration: Autonomous and Connected Electric Trucks

Emerging electric truck models increasingly feature advanced technologies like telematics, augmented reality for driver assistance, and autonomous driving capabilities. These tech integrations enhance safety, operational efficiency, and fleet management precision. For example, augmented reality provides real-time route and vehicle status information, reducing driver fatigue and improving delivery times. Autonomous electric trucks, still in pilot stages, promise to profoundly reduce labor costs and increase operational hours in logistics. Combined with electric drivetrains’ lower emissions and fuel savings, these innovations position electric trucks as the centerpiece of future smart, sustainable transport systems.

Our report provides a deep dive into the electric truck market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Leading Companies Operating in the Global Electric Truck Industry:

- VolvoGroup

- BYD Company Ltd.

- Mercedes-Benz Group AG

- China FAW Group Co. Ltd.

- Isuzu Motors Ltd.

- Navistar Inc.

- PACCAR Inc.

- Rivian Automotive Inc.

- Volkswagen AG

- Tata Motors Limited

- Tesla Inc.

- Tevva Motors Limited

Electric Truck Market Report Segmentation:

By Vehicle Type:

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truck

Light-duty trucks dominate the market in 2024 with approximately 63.8% share, favored for urban deliveries due to their zero emissions, lower operating costs, and maneuverability.

By Propulsion:

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

Hybrid electric trucks lead the market by combining an internal combustion engine with electric propulsion, enhancing fuel efficiency and reducing emissions while maintaining long-distance capability.

By Range:

- 0-150 Miles

- 151-300 Miles

- Above 300 Miles

The 0-150 miles range category is the market leader, ideal for urban deliveries and short-haul transportation, offering zero emissions and compliance with stringent urban regulations.

By Application:

- Logistics

- Municipal

- Construction

- Mining

- Others

Logistics holds a 38.7% market share in 2024, with electric trucks preferred for urban deliveries, driven by sustainability trends and supported by improved charging infrastructure.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America represents over 37.8% of the market in 2024, bolstered by advanced EV charging infrastructure, government investments, and favorable regulatory incentives for electric truck adoption.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Related Reads

- Custom Fitness App Development: Build the Fitness App Your Users Actually Want

- Quick & Affordable Microsoft Surface Battery Replacement Near You

- What Conditions Can IV Drip Therapy Help Improve?

- Top 10 Benefits of Choosing Home Nursing Services in Patna for Your Loved Ones

- SE Mattor – Olohuoneen matto, joka yhdistää tyylin ja mukavuuden

- Innovative Kitchen Furniture Design Ideas for Modern Interiors