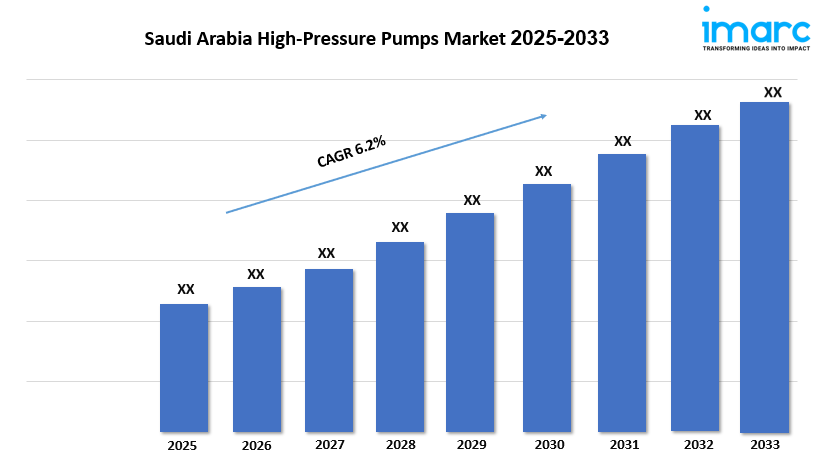

Market Overview

The Saudi Arabia high-pressure pumps market size was USD 39.99 Million in 2024 and is expected to grow to USD 68.72 Million by 2033. The market is forecasted to grow at a CAGR of 6.2% during the period of 2025-2033. Demand growth is driven by sectors such as oil and gas, power, and desalination, along with infrastructure expansion, industrial water treatment, and government-backed projects under Vision 2030. These factors collectively promote the adoption of high-pressure pumps for critical applications in the Kingdom.

- AI-enabled predictive maintenance reduces downtime and operational costs by optimizing pump performance through real-time monitoring and analytics.

- Government initiatives under Vision 2030 are integrating AI for sustainable water management, enhancing efficiency in desalination plants.

- Companies like VA Tech Wabag are incorporating AI in design and construction phases to improve high-pressure pump systems’ reliability.

- AI-driven energy optimization in pump operations supports reduced power consumption, aligning with Saudi Arabia’s sustainability goals.

- Advanced AI algorithms facilitate better fault detection and rapid troubleshooting, increasing the life span of high-pressure pumps in industrial uses.

- AI-powered data analytics allows for improved supply chain and inventory management, ensuring timely availability of pump components and reducing delays.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-high-pressure-pumps-market/requestsample

Market Growth Factors

Massive investments in national water infrastructure projects are significantly driving the Saudi Arabia high-pressure pumps market. The country’s allocation of over USD 12 Billion towards water and sanitation infrastructure—including desalination, water transmission, and wastewater treatment—demonstrates a robust commitment to expanding and upgrading facilities. These large-scale projects require high-performance, industrial-grade pumps capable of managing high water volumes under extreme pressures, especially in reverse osmosis and extended pipeline networks. Government-backed programs emphasizing long-term water sustainability further stimulate demand for advanced pumping technologies across coastal and inland installations, supporting consistent market growth.

The expansion of seawater desalination plants forms a crucial growth factor in the market. Large-scale seawater reverse osmosis (SWRO) plants in Saudi Arabia are increasing the need for energy-efficient and durable high-pressure pumps specifically designed to operate under continuous high-pressure conditions. For example, VA Tech Wabag’s EPC contract for a SWRO plant highlights a direct market impact, as such plants require pumps for forcing seawater through membranes effectively. These developments also encourage localized manufacturing, assembly, and maintenance services, supporting technology advancements that comply with environmental and operational standards, which is essential for Saudi Arabia’s water infrastructure sustainability goals.

Government vision and industrial diversification under Vision 2030 are also bolstering market growth by facilitating infrastructure expansion beyond water treatment. Enhanced demand from the oil and gas, power generation, and manufacturing sectors is propelling the adoption of high-pressure pumps across diverse end-use industries. Energy projects backed by the government necessitate reliable pumping solutions to support operational efficiency. This multi-sectoral demand, coupled with the infrastructure development pace, intensifies the requirement for robust, durable, and energy-optimized pumping systems, making the market increasingly competitive and dynamic.

Market Segmentation

- **Type Insights:**

- Positive Displacement

- Dynamic

- **Pressure Insights:**

- 30 Bar to 100 Bar

- 100 Bar to 500 Bar

- Above 500 Bar

- **End User Industry Insights:**

- Oil and Gas

- Chemicals and Pharmaceuticals

- Power Generation

- Manufacturing Industries

- Others

- **Regional Insights:**

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Key Players

- VA Tech Wabag

- Larsen & Toubro

Recent Development & News

- March 2025: Larsen & Toubro secured an EPC contract for a large-scale seawater reverse osmosis desalination plant in Saudi Arabia, highlighting ongoing infrastructure investments. This project necessitates high-pressure pumps for membrane-based water purification, boosting the demand for advanced pumping systems capable of managing high salinity and pressure.

- January 2025: Saudi Arabia announced new water and sanitation infrastructure projects valued at over USD 12 Billion aimed at desalination, water transmission, and wastewater treatment facilities. This initiative supports the Kingdom’s water security goals and fuels demand for industrial-grade high-pressure pumps essential to managing high-flow and high-pressure operations.

- September 2024: VA Tech Wabag was awarded an EPC contract for a major seawater reverse osmosis desalination plant with capacity to produce hundreds of thousands of cubic meters per day, indicating a strong market signal for advanced pump technologies to support the growing water infrastructure network in Saudi Arabia.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302