Market Overview:

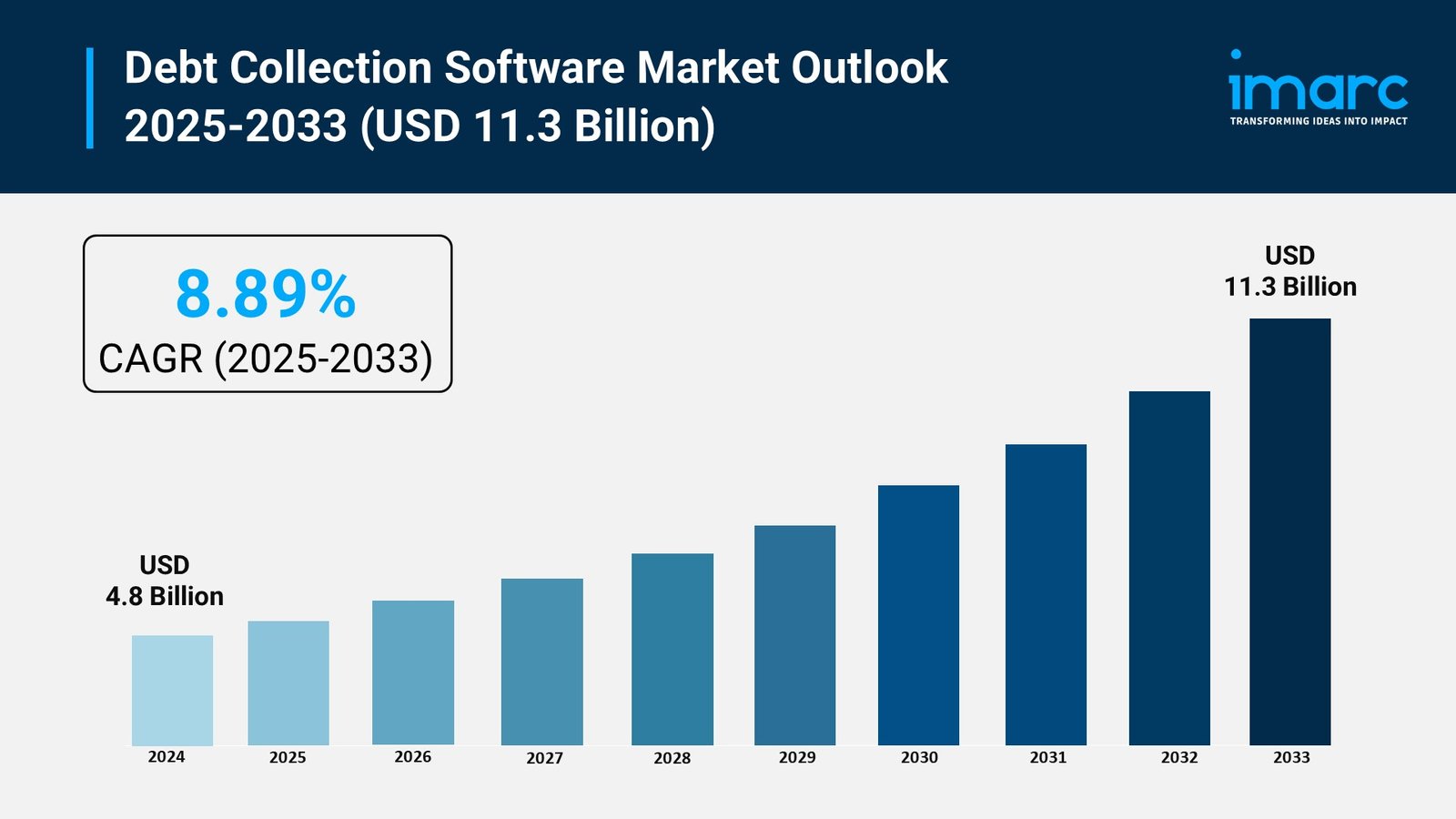

The debt collection software market is experiencing rapid growth, driven by surge in non-performing loans, stringent regulatory compliance needs, and rising demand for automation in debt recovery. According to IMARC Group’s latest research publication, “Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033”, The global debt collection software market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.3 Billion by 2033, exhibiting a CAGR of 8.89% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/debt-collection-software-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Debt Collection Software Market

- Surge in Non-Performing Loans

The global debt collection software industry is booming thanks to the steady rise in non-performing loans, which are putting real pressure on financial institutions to recover outstanding debts more effectively. Right now, the worldwide average non-performing loans ratio hovers around 5.5 percent across various economies, meaning a significant chunk of loans isn’t being repaid on time and is tying up capital that banks and lenders desperately need back in circulation. This situation is especially acute in emerging markets where economic volatility leads to higher default rates, forcing companies to seek smarter tools for tracking and pursuing these debts. For instance, recent reports from the European Commission highlight how NPL volumes in the EU alone represent billions in potential losses, pushing agencies toward software that can automate reminders and prioritize high-risk accounts. On the company side, firms like TransUnion have noted that without efficient recovery systems, lenders face up to 20 percent more write-offs annually. Government initiatives, such as the EU’s push for better NPL management through directives that encourage early intervention, are also fueling this demand by making it easier for software providers to integrate compliance features. Overall, this factor is transforming how businesses handle bad debt, turning a headache into an opportunity for streamlined operations and quicker cash flow recovery.

- Stringent Regulatory Compliance Needs

Navigating the maze of regulations is another big driver behind the growth of debt collection software, as governments worldwide crack down on unfair practices to protect consumers while keeping the financial system stable. Laws like the Fair Debt Collection Practices Act in the US set strict rules on how debts can be pursued, limiting aggressive tactics and requiring detailed record-keeping, which manual processes just can’t handle reliably. This has led to a surge in software adoption, with agencies reporting that compliant tools help avoid fines that can run into millions—think of cases where non-compliance has cost major players hefty penalties. In Europe, the GDPR adds layers of data privacy requirements, mandating secure handling of debtor information, and software solutions now often include built-in encryption and audit trails to meet these standards. Company news underscores this: Recent updates from firms like Experian show they’re rolling out AI-driven compliance modules to stay ahead of evolving rules from bodies like the Consumer Financial Protection Bureau. Statistics reveal that over 70 percent of collection agencies cite regulatory pressures as a top reason for upgrading to digital platforms, reducing error rates by up to 40 percent. These government-backed frameworks aren’t just hurdles; they’re creating a market where software becomes essential for ethical, efficient debt recovery that builds trust with both regulators and customers.

- Rising Demand for Automation in Debt Recovery

Automation is revolutionizing the debt collection software space by helping companies cut costs and boost efficiency in an industry bogged down by manual workflows. Financial institutions turning to these tools report operational savings of up to 90 percent, as software handles everything from initial notifications to payment scheduling without human intervention. This shift is particularly vital amid growing default rates, where quick action can make or break recovery efforts—agencies using automated systems see recovery rates climb by as much as 30 percent compared to traditional methods. Take recent developments at companies like FIS Global, which launched enhanced automation features in their debt management platforms, allowing seamless integration with CRM systems for real-time debtor tracking. Stats from industry surveys indicate that 60 percent of mid-sized lenders are now prioritizing automation to manage increasing volumes of overdue accounts, especially in sectors like telecom and healthcare where billing cycles are complex. Government schemes, such as the US Small Business Administration’s support for digital tools in financial services, further encourage this adoption by offering grants for tech upgrades that improve cash flow. In essence, automation isn’t just a nice-to-have; it’s becoming the backbone of modern debt collection, empowering teams to focus on strategy rather than paperwork and delivering faster results for everyone involved.

Key Trends in the Debt Collection Software Market

- Integration of AI and Machine Learning

One of the hottest trends shaking up the debt collection software market is the deep dive into AI and machine learning, which are making recovery efforts smarter and more personalized than ever. These technologies sift through vast amounts of debtor data to predict who’s likely to pay and when, optimizing contact strategies to hit the right moment—imagine software flagging the best time for a call based on past behavior, boosting response rates significantly. For real-world proof, Bank of America’s AI assistant, Erica, has already handled over 2 billion interactions, processing 2.1 million refunds monthly and helping millions track their finances, which indirectly aids in proactive debt management. In debt collection specifically, tools like predictive analytics from providers such as NobelBiz analyze repayment patterns to tailor plans, reducing defaults by suggesting flexible options that fit individual situations. This isn’t pie-in-the-sky stuff; agencies report up to 25 percent higher engagement when AI personalizes messages, like using natural language generation for empathetic reminders via email or chat. As more software embeds these features, it’s shifting the industry from reactive chasing to proactive partnership, making collections feel less like a confrontation and more like helpful guidance, all while cutting down on manual guesswork for teams.

- Shift to Omnichannel Communication Strategies

Omnichannel communication is emerging as a game-changer in debt collection software, letting agencies reach debtors across multiple platforms without missing a beat, creating a smoother experience that encourages repayments. This means blending SMS for quick nudges, email for detailed breakdowns, chatbots for instant queries, and even voice calls—all synced in one system so the conversation picks up right where it left off. A practical example comes from U.S. Bank’s use of predictive personalization, where their app suggests auto-pay setups based on user habits, leading to higher on-time payments and fewer escalations to collections. Numerical insights show this approach can lift engagement by 40 percent, as debtors prefer the flexibility; for instance, SMS reminders resolve 20 percent more cases than phone calls alone because they’re less intrusive. Software like that from InDebted integrates these channels seamlessly, allowing self-service portals where users can view balances and set plans on their phone or computer. In action, telecom giants are using it to handle utility bills, reducing agent workload by routing simple issues to digital touchpoints. This trend is all about meeting people where they are, turning fragmented outreach into a unified journey that builds rapport and speeds up resolutions in a digital-first world.

- Focus on Ethical and Consumer-Centric Practices

The push toward ethical debt collection is gaining serious traction in the software market, emphasizing respect and transparency to foster trust rather than fear, especially as consumers demand fair treatment. This trend incorporates behavioral science into tools, like structuring repayment options with “nudges” such as default easy plans or social proof showing what others chose, which can increase voluntary payments by 15-20 percent. Real-world applications shine in self-service features from platforms like BridgeForce, where RCS messaging lets debtors interact interactively—viewing balances or selecting plans right in the chat—making the process feel empowering. Regulations like the FDCPA reinforce this by prohibiting harassment, and software now flags risky language in scripts to ensure compliance, with agencies noting a 30 percent drop in complaints after implementation. For example, Citibank’s digital tools use sentiment analysis to gauge debtor mood during calls, switching to empathetic responses that de-escalate tensions. Stats from surveys reveal 50 percent of people still prefer human agents for sensitive talks, so hybrid models blend AI efficiency with personal touch. Ultimately, this evolution is rebranding collections as supportive services, helping software providers win loyalty while navigating a landscape where one bad interaction can go viral.

Buy Full Report: https://www.imarcgroup.com/checkout?id=4528&method=1670

Leading Companies Operating in the Global Debt Collection Software Industry:

- AgreeYa.com

- Chetu Inc.

- Debtrak

- EbixCash Financial Technologies

- Experian Information Solutions Inc.

- Fair Isaac Corporation

- Katabat Corporation (Ontario System)

- Nucleus Software Exports Ltd.

- Pegasystems Inc.

- Seikosoft

- TietoEVRY

- TransUnion LLC

Debt Collection Software Market Report Segmentation:

By Component:

- Software

- Services

Software leads with 65.2% market share in 2024, driven by digital transformation in financial institutions that enhances debt recovery processes through advanced functionalities and integration.

By Deployment Mode:

- On-premises

- Cloud-based

On-premises solutions dominate due to their security and control advantages, allowing organizations to manage sensitive data internally and integrate seamlessly with existing systems.

By Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Large Enterprises hold 55.0% market share in 2024, requiring robust debt collection software to manage extensive financial data, optimize recovery strategies, and accommodate diverse debtor profiles.

By End User:

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

- Others

Financial Institutions lead the market by utilizing debt collection software to manage customer debts efficiently, improve cash flow, enhance customer relationships, and leverage data-driven insights.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America captures over 30.7% market share in 2024, fueled by the adoption of advanced technologies, a robust ecosystem of key players, and the integration of cloud-based solutions for efficient debt recovery.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302