In today’s fast-paced financial environment, lenders are under constant pressure to process loans efficiently while ensuring compliance and minimizing risks. Loan Origination Software has emerged as a game-changer for banks, credit unions, and financial institutions, transforming traditional loan processing into a seamless digital experience. Intelligrow Consultancy Services Pvt Ltd brings cutting-edge solutions that simplify the entire loan lifecycle, making it easier for lenders to serve customers effectively.

What is Loan Origination Software?

Loan Origination Software (LOS) is a specialized platform designed to automate and manage the end-to-end loan application process. From application submission to approval and disbursal, LOS helps financial institutions streamline workflows, reduce manual errors, and enhance customer satisfaction.

Traditionally, loan processing involved tedious paperwork, multiple approval stages, and long waiting times. With Loan Origination Software, these steps are automated, reducing processing time and enabling faster decision-making.

Key Features of Loan Origination Software

Modern LOS platforms, like those offered by Intelligrow Consultancy Services Pvt Ltd, come packed with features that empower lenders to operate more efficiently.

1. Digital Application Management

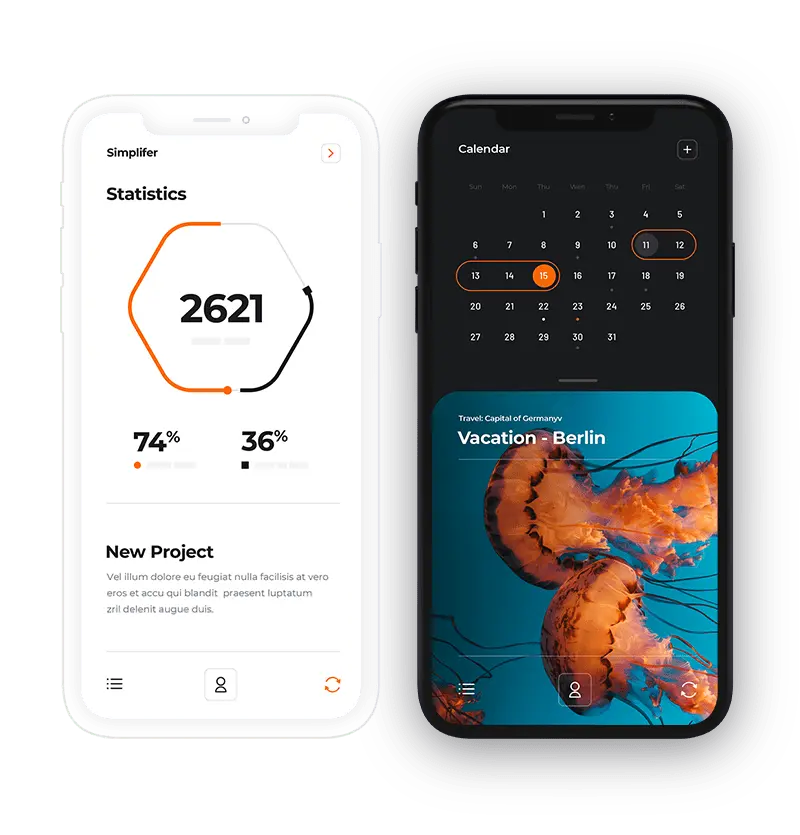

Gone are the days of paper-heavy loan applications. Loan Origination Software allows customers to submit applications online, upload documents securely, and track application status in real-time. This not only improves customer experience but also reduces administrative burden.

2. Automated Credit Scoring and Risk Assessment

LOS platforms integrate advanced analytics and AI-driven algorithms to evaluate applicant creditworthiness. Automated credit scoring ensures consistent and unbiased risk assessment, enabling faster approvals while minimizing default risks.

3. Workflow Automation

From verification to underwriting, Loan Origination Software automates repetitive tasks, ensures adherence to regulatory standards, and reduces human errors. Lenders can define custom workflows tailored to their unique business needs.

4. Compliance Management

Financial institutions must comply with strict regulatory requirements. LOS solutions provide built-in compliance checks, audit trails, and reporting features to ensure that every loan meets legal standards, reducing the risk of penalties.

5. Seamless Integration

Modern LOS platforms integrate smoothly with core banking systems, CRM software, and third-party verification services. This integration ensures data consistency, faster processing, and a unified digital ecosystem.

6. Real-Time Analytics and Reporting

Loan Origination Software offers real-time insights into loan pipelines, approval rates, and portfolio performance. Financial institutions can make informed strategic decisions, optimize processes, and identify potential bottlenecks.

Benefits of Implementing Loan Origination Software

Financial institutions adopting Loan Origination Software enjoy multiple advantages that enhance operational efficiency and customer satisfaction.

1. Faster Loan Processing

Automation reduces manual intervention, enabling lenders to process loans quickly. Customers benefit from faster approvals and reduced turnaround times, leading to higher satisfaction and loyalty.

2. Enhanced Accuracy and Reduced Errors

Manual loan processing is prone to errors, leading to delays and compliance issues. LOS ensures data accuracy, reduces mistakes, and maintains consistent documentation throughout the loan lifecycle.

3. Improved Risk Management

With automated credit scoring, risk assessment, and real-time monitoring, Loan Origination Software helps institutions minimize default rates and make data-driven lending decisions.

4. Cost Efficiency

Automation reduces administrative overhead, lowers operational costs, and eliminates inefficiencies. Over time, the ROI from LOS implementation is substantial for financial institutions.

5. Better Customer Experience

A digital, transparent, and fast loan processing system improves customer engagement. Borrowers can track applications, receive timely updates, and complete processes with minimal effort.

6. Regulatory Compliance

Built-in compliance tools ensure that all loan processes adhere to regulatory requirements, reducing the risk of audits, fines, or legal complications.

How Intelligrow Consultancy Services Pvt Ltd Enhances Loan Processing

Intelligrow Consultancy Services Pvt Ltd specializes in providing robust, scalable Loan Origination Software tailored to the needs of modern lenders. Here’s how their solutions stand out:

- Customized Solutions: Every financial institution has unique needs. Intelligrow offers tailored LOS solutions that align with organizational workflows and customer requirements.

- Advanced Technology: Leveraging AI, machine learning, and cloud computing, Intelligrow ensures faster processing, predictive analytics, and secure data management.

- Seamless Integration: The software integrates effortlessly with existing banking systems, reducing implementation challenges and downtime.

- Security and Compliance: Intelligrow prioritizes data security and regulatory compliance, ensuring that sensitive customer information is protected at all stages.

- User-Friendly Interface: Both lenders and borrowers experience an intuitive interface, making loan management simple and efficient.

Industries That Benefit from Loan Origination Software

Loan Origination Software is versatile and can be applied across multiple sectors:

- Banking and Financial Institutions: Automates loan processing, underwriting, and compliance.

- Credit Unions: Enhances member experience and reduces administrative workload.

- Mortgage Companies: Streamlines mortgage application processing and verification.

- Microfinance Organizations: Improves efficiency in small-scale lending operations.

- Online Lending Platforms: Supports fully digital loan origination and instant approvals.

By implementing LOS, these industries can reduce turnaround times, minimize errors, and enhance customer engagement.

Key Considerations When Choosing Loan Origination Software

Selecting the right LOS is critical to achieving operational efficiency. Here are key factors to consider:

- Scalability: Ensure the software can grow with your institution.

- Integration Capabilities: Check compatibility with existing systems and third-party services.

- User Experience: Look for intuitive interfaces for both staff and customers.

- Security Features: Verify robust encryption, access control, and compliance tools.

- Support and Maintenance: Reliable vendor support ensures smooth operation and quick issue resolution.

Intelligrow Consultancy Services Pvt Ltd excels in providing solutions that meet all these requirements, ensuring a seamless digital transformation.

The Future of Loan Origination

The future of lending is digital, and Loan Origination Software is at the heart of this transformation. AI-driven analytics, cloud-based platforms, and mobile-first applications are redefining how loans are processed, approved, and monitored.

Financial institutions adopting modern LOS solutions gain a competitive edge by:

- Reducing operational costs

- Enhancing borrower experience

- Increasing loan approval speed

- Minimizing compliance risks

- Leveraging data for smarter decision-making

As technology evolves, LOS will continue to play a pivotal role in shaping the lending industry, making processes faster, smarter, and more secure.

Conclusion

Loan Origination Software is no longer optional—it’s essential for any financial institution aiming to improve efficiency, reduce errors, and deliver superior customer experiences. Intelligrow Consultancy Services Pvt Ltd provides cutting-edge solutions that automate loan workflows, ensure compliance, and empower lenders to make informed, data-driven decisions.

By investing in advanced LOS, financial institutions can transform traditional lending into a seamless, digital experience—benefiting both lenders and borrowers alike. If you’re looking to modernize your loan processing operations, Intelligrow’s Loan Origination Software is the trusted solution to drive efficiency and growth.

Related Reads

- Custom Fitness App Development: Build the Fitness App Your Users Actually Want

- The Mental and Physical Health Benefits of Green Exercise

- How Can You Choose the Right Wall Moulding for Your Space?

- How a CRM Software Development Company Improves Sales?

- Boat from Toronto to Niagara Falls: Real Reviews, Must-See Stops & Insider Advice

- How Does Glycolic Acid Peel Brighten Sun-Damaged Skin?